Contrary to popular belief, it’s easy to avoid paying interest on credit card purchases. Simply pay your statement balance in full each month and, with most card issuers, that does the trick.

Sometimes credit card issuers have special promotional offers, known as deferred interest financing. These offers give you a chance to avoid interest in another way. With deferred interest, you can make a purchase now and pay it off later. In the meantime, you won’t pay any interest on qualifying purchases during the special financing period.

Sound too good to be true? It might be. There’s a catch and a potentially expensive one at that.

If you don’t understand how deferred interest works, you could still wind up paying all of those interest fees before, during, or after the promotional period expires.

What Is Deferred Interest?

Deferred interest is interest that you’ve accrued on an account, but haven’t yet paid. Instead, the interest is delayed (aka deferred) for a period of time (so it’s a bit different than a 0% APR offer).

If you pay off your balance before the interest-free period expires, you could genuinely enjoy short-term interest-free financing. But if you don’t pay off the total balance by the offer’s deadline, or if you miss a payment, the interest that’s been accruing in the background may be added to your account in one lump sum.

How Does Deferred Interest Work?

Deferred interest offers come in a variety of forms. They are commonly marketed by retailers and other companies for the purchase of big-ticket items like appliances, electronics, furniture, or even medical procedures.

Below is a hypothetical example of how a deferred interest offer on a credit card might work.

- A retail credit card issuer offers “no interest if paid in full in 12 months” when you use your account to buy new appliances.

- You charge $2,000 worth of appliances on your account.

- At first, you pay $250 per month because you have a goal to reach a zero balance before the payoff deadline.

- Later, you start making the minimum monthly payments on your account instead.

- When the 12-month promo period expires, you have an unpaid balance of $500.

- The card issuer retroactively charges you interest (at the account’s regular APR) on the full $2,000 original purchase. The interest is tallied from your purchase date forward.

- The full interest amount shows up on your next credit card statement.

Deferred interest vs. 0% APR

A deferred interest offer isn’t the same as 0% APR on a credit card. Either option could potentially help you save money on interest fees. But 0% APR is hands down a better deal.

- Deferred Interest: Interest gets calculated in the background. If you miss a payment or owe any remaining balance when the promo period ends, all of the interest that accrued from the date of purchase will be added to your account.

- 0% APR: No interest gets calculated in the background during the 0% APR period. When the promotional period ends, any remaining balance or future purchases are subject to the regular APR on the account. But no interest is charged retroactively, whether you’re carrying an outstanding balance or not.

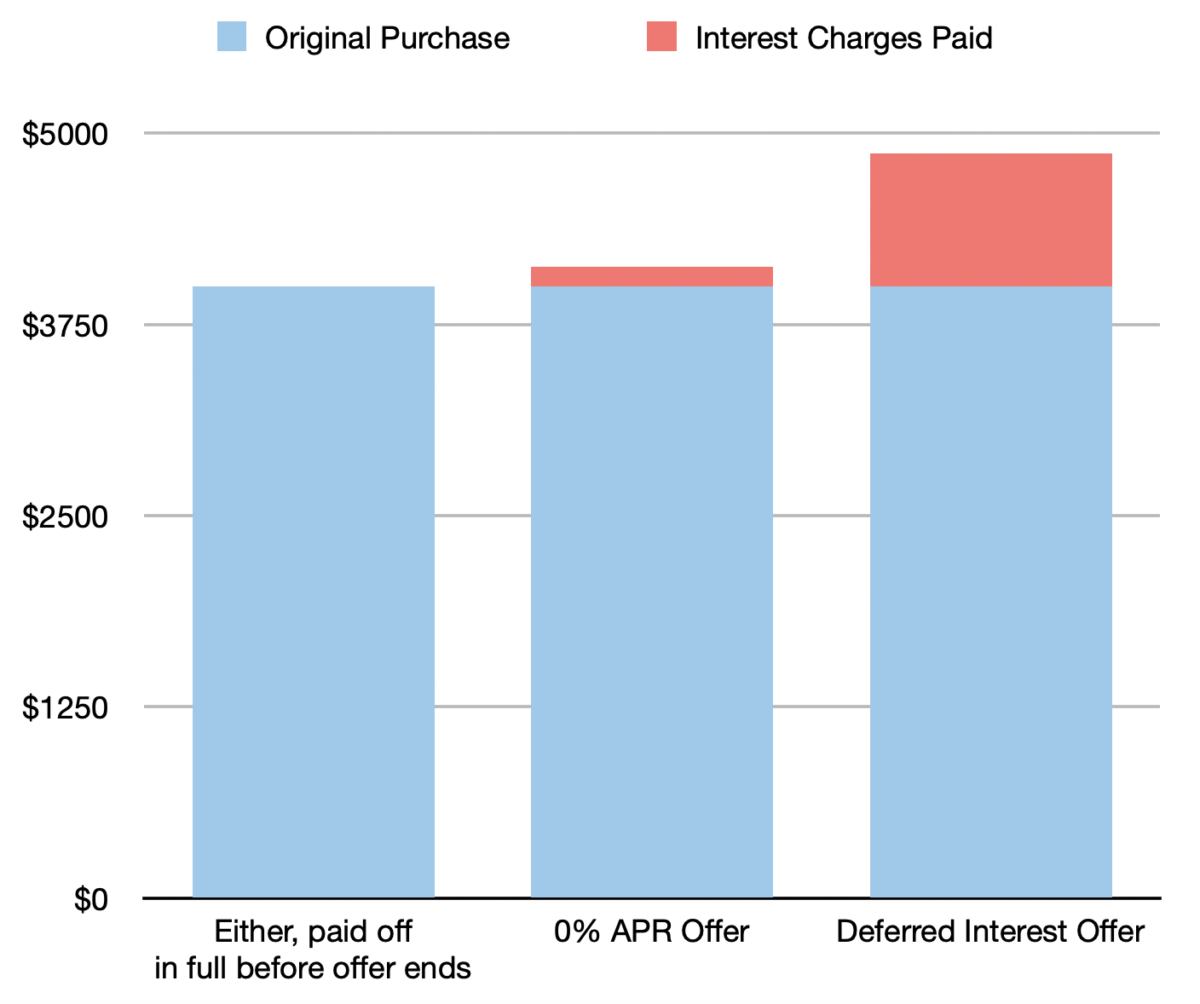

The following chart provides a side-by-side comparison between a 0% APR offer and a deferred interest promotion. In this example, the 0% APR and deferred interest plans only last for one year, but the hypothetical borrower ends up taking two years to pay off the full balance. This illustrates how much extra you’ll pay with deferred interest financing.*

| 0% APR | Deferred Interest | |

| Promotional Offer | 0% for 12 months | No interest if paid in full in 12 months |

| Purchase Amount | $4,000 | $4,000 |

| Amount Paid During the Promotional Period ($250/month) | $3,000 | $3,000 |

| Remaining Balance (Principal) When Promo Expires | $1,000 | $1,000 |

| Interest Rate During Promo Period | 0% | 25% |

| Interest Accrued During Promo Period | $0 | $656 |

| Interest Rate After Promo Period | 25% | 25% |

| Amount Owed When Promo Period Ends | $1,000 | $1,656 |

| Amount Paid in 12 Months After Promotional Period (at 25% interest) | $1,126 | $1,865 |

| Total Interest Paid | $126 | $865 |

| Total Amount Paid | $4,126 | $4,865 |

*Note: This example is hypothetical. The amount of interest you pay will vary based on the terms of your account.

As you can see, paying $250 per month for 12 months isn’t enough to finish off the full $4,000 balance. And after those 12 months, the results are very different with a 0% APR plan versus deferred interest financing.

With the 0% APR plan, after those 12 months, only the remaining balance ($1,000) will be subject to the 25% interest rate. If you pay off that balance over 12 months, you’ll pay about $126 in interest.

But with the deferred interest plan, the balance had to be fully paid off in time — otherwise, the interest wouldn’t be deferred. So, since there was $1,000 left to pay, that interest gets added back on. In this case, the interest amounted to $656, leaving you with $1,656 left to pay at an interest rate of 25%. If you take 12 months to pay that off, you’ll pay about $209 in interest.

So, when it’s all said and done, you’d pay $4,126 with the 0% APR plan, or $4,865 with the deferred interest plan.

You can easily see the monetary consequences of each offer, compared to how much you’d spend if you pay off the balance in that first year:

Deferred interest and zero-interest offers may sound similar on the surface. Yet, as you can see, these two types of offers can have very different impacts on your bank account (and potentially your credit scores).

Does Deferred Interest Hurt Your Credit?

Deferred interest financing shouldn’t impact your credit any more than carrying an ordinary balance would. While you’re carrying the balance, your scores may drop a bit, given the importance of your debt-to-limit ratio in most credit scoring formulas. You can also damage your scores by missing your monthly payments, which you’ll still be required to pay for the duration of the deferral period. Otherwise, pay off your full balance before the deferral period ends, and you should be fine.

However, if you fail to pay off your balance by the time the promotional period ends, then you’ll be charged interest on the full balance from day one. If those interest charges are large enough, then they could adversely impact your credit the same way the balance did in the first place — simply because they’ve increased your balance.

Does My Credit Card Charge Deferred Interest?

Deferred interest is rare among credit cards from major issuers. Instead, deferred interest offers are more common with retail store credit cards and co-branded credit cards.

If you want to find out whether your credit card charges deferred interest on certain purchases, one of the following approaches may help.

- Check your credit card agreement

- Search the credit card issuer’s website

- Call customer service

Certain terms may indicate a card offer is subject to deferred interest. For example, there may be cause for concern if you come across terms such as:

- Deferred Interest

- Retroactive Interest

- No Interest If Paid In Full

How Should You Manage a Deferred Interest Offer?

If you already signed up for a deferred interest offer, the following strategies might help you avoid common pitfalls.

- Pay the balance in full before the no-interest period ends. This is the easiest way to avoid retroactive interest charges. Consider setting up automated payments to make sure you’re paying enough to satisfy the balance in full before the payoff deadline. Divide the total balance by the number of months you have to pay, and that should be your monthly payment (consider dividing by one fewer month to pay it off early).

- Don’t use the card for any new purchases. When you use your account for new charges (at your regular APR), payments above the minimum amount due will be applied to that higher-interest balance first. This is a requirement under the Credit Card Accountability Responsibility and Disclosure Act (aka the CARD Act).

- Consider a balance transfer. Can’t afford to pay off your balance before the no-interest period expires? A balance transfer credit card might save you money until you can eliminate your debt.

- Understand and avoid the consequences of a late payment. Depending on the terms of the offer, a late payment might revoke your deferred interest period immediately. This could trigger the debt avalanche and add interest charges on the entire balance for the entire length of the loan.

Why Deferred Interest Is Best Avoided

It’s best to avoid deferred interest offers altogether. Unless you’re 100% certain you can pay off your full balance before the no-interest period ends, these promotional offers could come back to bite you.

The smartest way you can manage your credit cards is to never charge anything on an account that you can’t afford to pay off right away. If you need affordable, short-term financing for an emergency expense, either a 0% APR credit card or a low-interest personal loan should be a safer bet.

The Short Version

- If you don’t pay it off in time, the interest that accrued may be added to your account in one lump sum

- Because payment for the interest is delayed (deferred), it’s not the same as a 0% APR offer, where interest is not charged

- They are commonly used to finance big-ticket items like appliances, electronics, furniture, or even medical procedures