So you’ve heard the word “FICO®” before.

Maybe from your mom, who’s always telling you to “stay on top of your FICO® scores.”

Or maybe from your prospective landlord, who wants to “check your FICO®” before he’ll let you live in his apartment.

But what does FICO® stand for? And why is it so important?

What Does FICO® Stand For?

Despite sounding mysterious, the acronym’s origins are pretty straightforward: FICO® stands for Fair Isaac Corporation, a financial services company founded in 1956 by an engineer named Bill Fair and a mathematician named Earl Isaac.

The pair wanted to use data to help businesses make better decisions. It started using predictive analytics to create “credit scores” that would help businesses determine how much credit risk a potential borrower posed.

In 1958, it introduced its first credit scoring system, and in the late ’80s, it rolled out FICO® credit scores.

What Are FICO® Scores?

FICO isn’t a credit reporting agency. Instead, it uses reports from the three major credit bureaus — Equifax, Experian, and TransUnion — to determine your FICO credit scores.

Lenders, in turn, use these scores to assess your level of credit risk: The higher your score, the less likely you are to default on a loan.

So, if your FICO® scores are high, lenders will be eager to give you money, and will offer attractive interest rates. If your scores are low, they’ll be more wary, and may deny your application — or offer high interest rates to hedge their risk.

Though people often refer to “your FICO® score” in the singular, you actually have dozens. Each is based on a single credit report from one of the credit bureaus.

They vary based on:

- Credit bureau: Since the credit bureaus all have slightly different information about you, and each score is based on just one bureau’s report, your scores may vary depending on which is used.

- Type of loan: Different FICO® scoring models are used for different loans; i.e. the FICO® score a car dealership sees may be different from the FICO® score a mortgage lender does.

- Scoring models: Just like software, FICO scores get updated. FICO® Score 10 is the most recent, but many lenders still use version 8.

Though we’re focused on FICO® scores for this article, they’re not the only credit score around. The three major credit bureaus introduced “VantageScore®” back in 2006.

The main difference between FICO® and VantageScore® is the latter can be generated using just a month or two of credit history. With FICO® scores, you usually need at least six months of history to generate a score.

Most lenders will check your FICO® scores rather than VantageScores. But since they use similar credit scoring models, maintaining good FICO® scores will also lead to good VantageScores.

What’s In Your FICO® Scores?

Your FICO® scores aren’t set in stone. They change frequently, even from month to month, depending on your credit behavior.

Here’s a breakdown of what affects them:

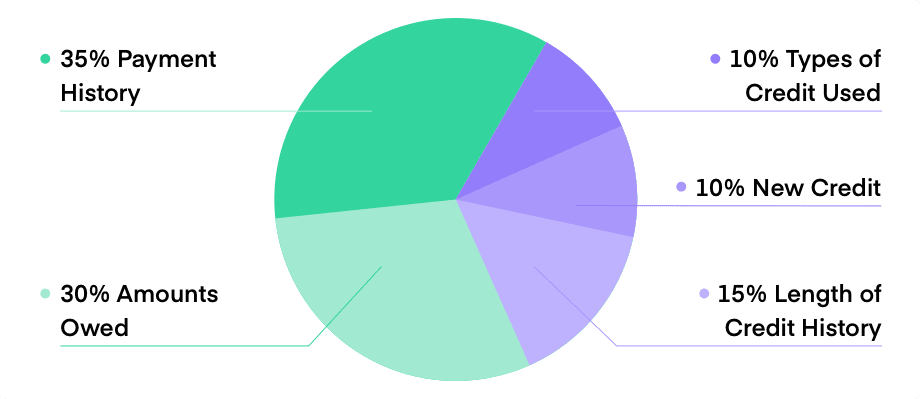

What’s In Your Credit Score?

This chart shows the criteria used to create FICO® scores and their relative importance in your credit score.

- Payment history: Have you paid your past bills on time?

- Amounts owed: How much of your available credit are you using? What is your credit utilization?

- Length of credit history: How long have your credit accounts been open? Have you used them recently? (This is why we recommend keeping unused cards open.)

- Credit mix: Do you have experience with both revolving debt, like a credit card, and installment debt, like an auto loan?

New credit: How many accounts have you opened recently? Opening several lines of credit in a short amount of time can say “credit risk!” to lenders.

Never used credit before? Then you probably don’t have FICO® scores. FICO® typically requires you to have six months of payment history before it’ll be able to generate your scores. Here’s how to build your credit file with credit cards.

What’s a Good FICO® Score?

Here are the FICO® score ranges for FICO® Score 8, according to myFICO.

| FICO® Score Range | Credit Rating |

| 579 or lower | Poor |

| 580–669 | Fair |

| 670–739 | Good |

| 740–799 | Very Good |

| 800 or above | Exceptional |

Once you get into the upper end of the “Good” range, you can expect to be approved for most offers you apply for, although you won’t always get the best possible rates. While there isn’t a special prize for having credit scores above 800 or a perfect score of 850, a high score can provide a nice cushion in case your score falls.

You should also be aware that credit card issuers base approval decisions on more than just one of your credit scores. Even if you have great FICO® scores, for example, a financial institution may deny you for certain items on your credit reports or your income.

Where To Check Your FICO® Scores for Free

Now that you know what FICO® stands for, you’re probably eager to see your scores.

The easiest way to view a free FICO® score is through the Discover® Credit Scorecard. This tool is available to anyone, whether you have a Discover® credit card or not. Discover® cardholders will see FICO® scores based on their TransUnion® reports, while non-cardholders will see scores based on their Experian™ reports.

Why Your FICO® Scores Matter

Though credit scores might not seem like an exciting topic, they’re extraordinarily important for your financial well-being.

And FICO® scores, in particular, matter: 90% of “top lenders” use them to make lending decisions.

Those lending decisions go beyond whether or not you’ll receive a shiny new credit card. They affect all areas of your life, including your ability to get a job or an apartment, and the interest rates you’ll pay on an auto loan or mortgage.

So it’s vital you stay on top of your scores. If you want to improve your FICO® scores, here are a few steps you should follow:

- Pay your bills on time: This is the cardinal rule of credit. Don’t pay late, and don’t miss payments. We recommend putting your bills on autopay so you reduce the inevitability of human error.

- Reduce your credit utilization: Part of your credit scores is how much of your available credit you’re using. Try to keep your credit card balances low or nonexistent. You can also ask for a higher credit limit from your credit card company.

- Keep old cards open: If your card is paid off and has no annual fee, don’t close it. Keep it open to maintain your length of credit history and reduce your utilization, even if you don’t use it anymore.

When you have excellent FICO® scores, you can snag the best interest rates and the best credit cards. When you have bad credit scores, you may have trouble getting a landlord to lease you an apartment.

So, if you think about it, FICO® stands for much more than just a credit score — it stands for financial opportunity.

The Short Version

- FICO® stands for Fair Isaac Corporation, a financial services company founded in 1956 by an engineer named Bill Fair and a mathematician named Earl Isaac.

- 90% of “top lenders” use FICO® scores to make lending decisions. The higher your score, the more likely lenders will be eager to give you money at attractive interest rates.

- The easiest way to view a free FICO® score is through the Discover® Credit Scorecard. This tool is available to anyone, whether you have a Discover® credit card or not.