You’ve finally made it to the register, clothes piled high, socks and ties slung across your shoulders, and a box of new shoes at your feet. You manage to get everything onto the counter and the young, bright-eyed cashier asks, “Do you have a JCPenney Credit Card?”

You don’t, which prompts the inevitable reply: “Would you like to sign up? It only takes a second!”

The store’s running a promotion. Sign up now, and you’ll get 30% off your total today. You think, that doesn’t sound so bad, why not? It only takes a second, after all.

With the holiday season creeping up (faster than most parents would like), this scenario will likely play out thousands of times. Some of you might already be thinking of snagging a co-branded store card, or perhaps there’s one in your wallet right now?

If you fall into one of these two groups, the 2019 and 2020 annual survey revealed information you’ll likely find helpful. Some of our main findings include:

- One-fifth of people surveyed report still having debt left over from the 2019 holiday season

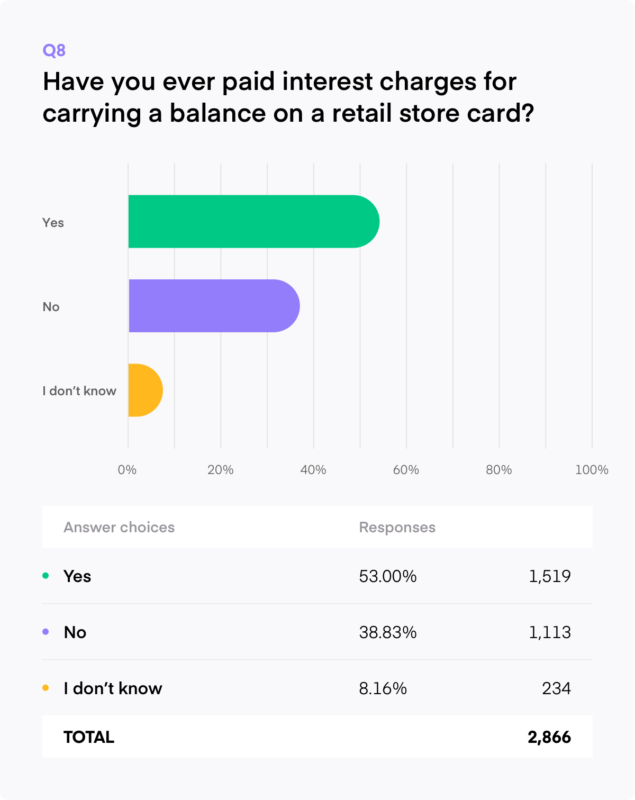

- Over half of the survey respondents have paid interest charges from a store credit card

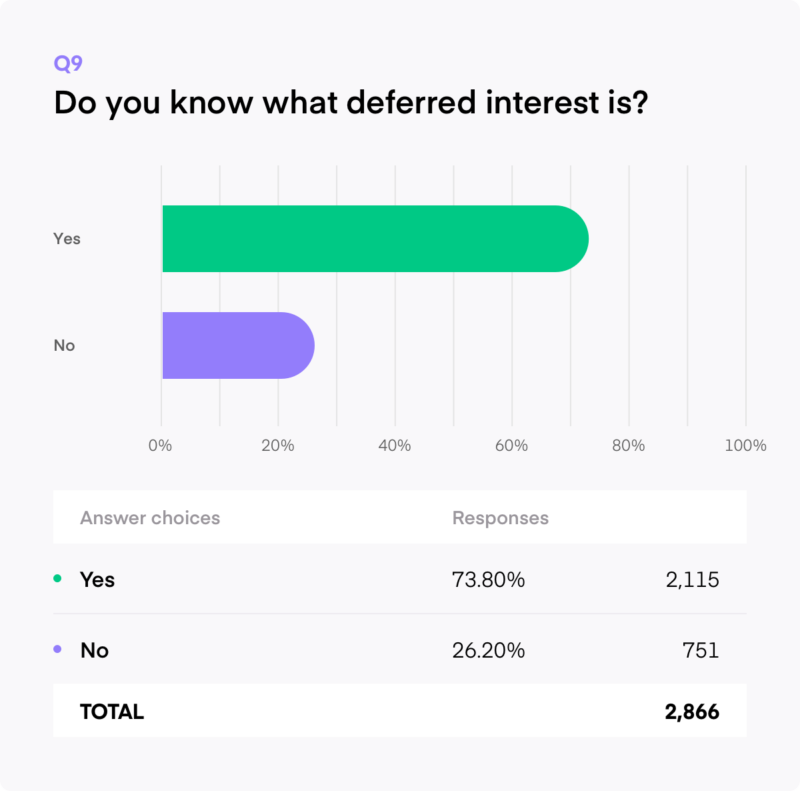

- One-fourth of respondents aren’t informed about deferred interest programs

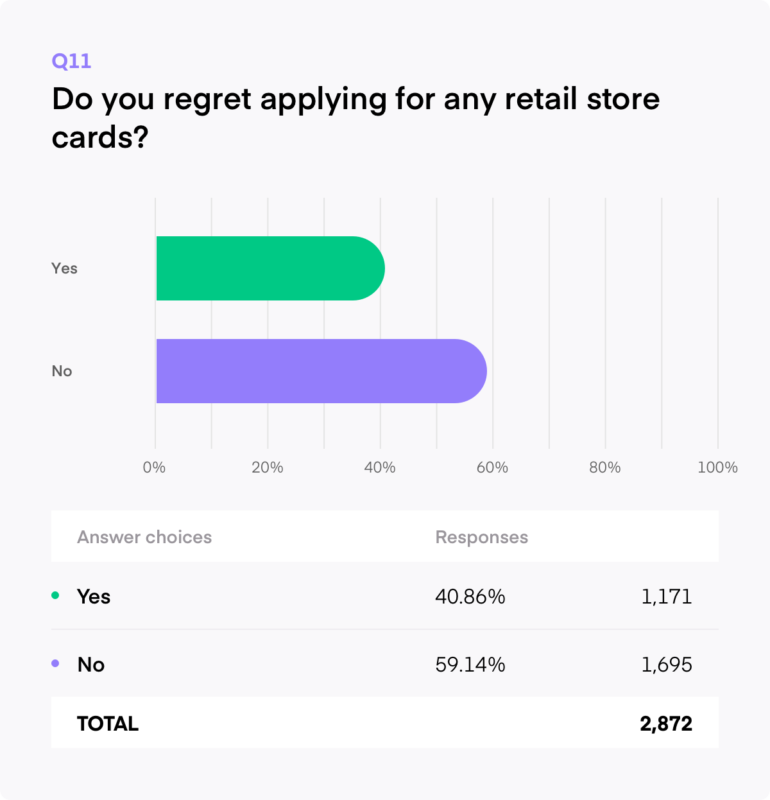

- 41% of respondents regret applying for a retail store credit card, a slight increase over our 2019 survey

- 51% of respondents indicated they’d rather shop online than in-store. That’s an increase of 16 percentage points compared to last year

It’s important to understand what you’re getting into. Store cards typically have higher APRs than standard credit cards, and some offer special financing or deferred interest offers to help pay off large purchases. However, these can actually be more costly if you don’t know the ins and outs of how they work.

If you’re being hit with interest charges on a card with a high APR, you could be in a financial pickle. The good news is, we can offer strategies on how to avoid interest, and shine some light on how deferred interest offers work, while breaking down the rest of the data we’ve compiled.

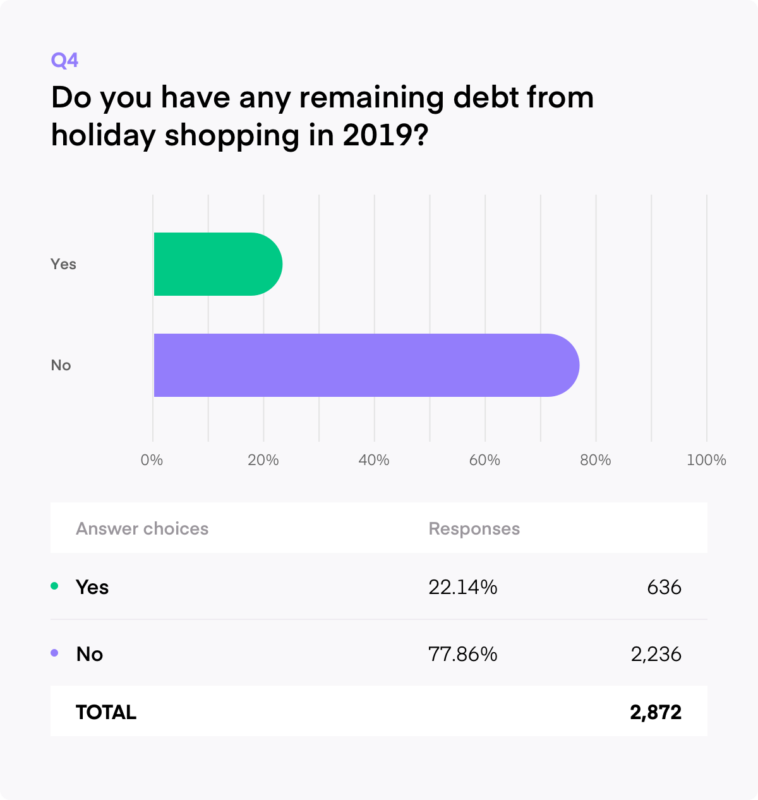

Over 20% of Respondents Have Lingering Holiday Debt

Debt is something countless people struggle with, and unfortunately, holiday shopping doesn’t make it any easier. Of the respondents in 2020, 22% indicated they’re still carrying debt from the 2019 holiday season. There are several debt-relieving strategies that can help, however, like the snowball method and (our favorite) the avalanche method.

Carrying a balance on your card can lead to interest charges, which are particularly troublesome if you’re holding that balance on a high-APR retail store card.

Would you knowingly apply for a store card with a high APR?

Take a look at some of the most popular retail credit cards and their corresponding APRs (as of 2020):

| Card | Purchase APR |

| Old Navy Credit Card | 25.99% Variable |

| Amazon Prime Store Card | 25.99% Variable |

| TJX Rewards® Credit Card | 26.99% Variable |

| Victoria’s Secret Angel Card | 24.99% Variable |

| Macy’s Credit Card | 25.24% Variable |

| Walmart Rewards Card | 26.99% Variable |

| JCPenney Credit Card | 25.99% Variable |

| Gap Credit Card | 25.99% Variable |

| Uber Credit Card | 17.49%, 23.49% or 28.24% Variable |

| SaksFirst Store Card | 23.99% Variable |

But what do those percentages actually mean? Just over half of those surveyed indicated that they’ve paid an interest charge on a retail store credit card, so a lot of people found out the hard way.

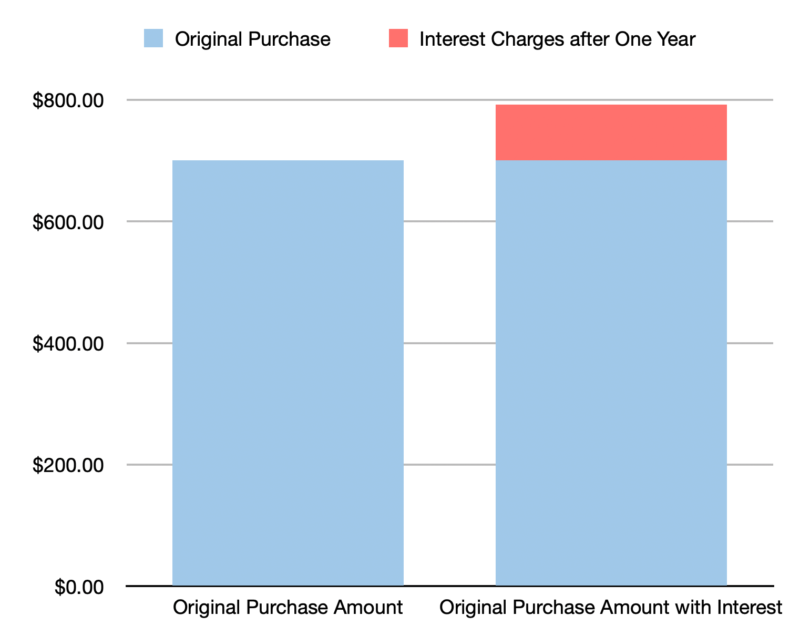

If you have a store card with an APR of 26%, for example, and you carry a $700 balance for a year, you’d end up paying a total of about $792 after interest. There’s more than one way to calculate interest, so actual charges can vary. But in this case, that’s $92 more than you needed to pay, and if you repeat this process for other purchases and other cards, that could add up to a hefty sum.

To figure out your monthly interest charge, most store cards apply the daily balance method. That means each day the credit card issuer will look at your daily balance and apply the daily interest rate to it.

Your daily balance is the balance at the end of the previous day, plus the interest charge and any new charges you’ve made on the current day. In order to figure out the daily interest rate, you take your annual interest rate (APR) and divide it by 365. In this instance, your daily interest rate would be .0007% (26%/365).

This occurs every day for the entire billing cycle. At the end of the cycle, all of your interest payments are compounded into one, and then applied to your statement balance. So the faster you pay down your balance, the less interest you’ll be charged.

Hanging on to that debt will lead to a lighter wallet. Therefore, carrying a balance is something we recommend avoiding, if you can. Instead, pay your statement balance in full by the due date. (Cards with 0% APRs are an exception.)

The key is to not spend money you don’t have. If you’re having trouble, try thinking of your credit card as more like a debit card, and only charge what you can afford to pay off immediately.

How Can You Avoid Interest Payments?

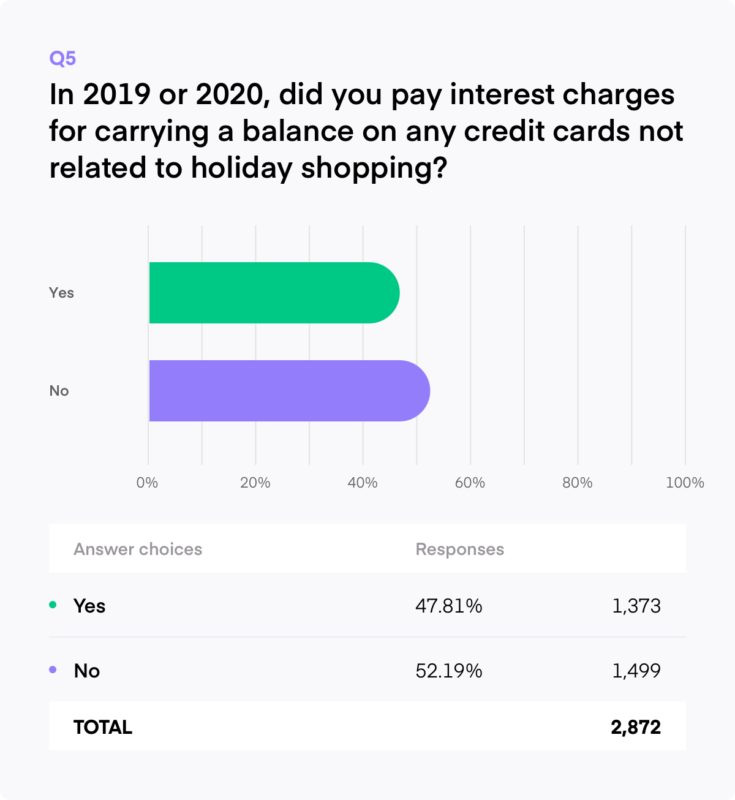

Nearly half of the people surveyed reported interest charges from carrying a balance not related to holiday spending. You can avoid interest with the right know-how – just pay your statement balance in full and on time, every single month.

And, here’s a little-known fact that’s working for you in the background: Most credit cards come with a grace period for purchases.

A grace period is the time between when your statement period ends and your billing due date. During that period, your purchases from the previous statement won’t accrue interest as long as you’ve been paying your balance in full each month. So again, it’s important to not spend money you don’t have to ensure you’ll be able to clear your balance every month.

Over half of our participants indicated they’ve paid interest charges on their retail store cards. Like we said, that’s something that doesn’t necessarily have to happen.

But, 8% also indicated they’re unsure if they’ve paid interest or not. You should regularly review your credit card statements for extra or unfamiliar charges. You don’t want to pay more than you have to, and it’s always good to know where your money is going.

If there are interest charges going unnoticed, plugging those holes means more money back in your pocket. It could be a pretty simple fix, too. Just take a look at your credit card statement to find all of your payment information for each month, or check your online account for full records.

The answers for the above two questions were consistent with our findings from last year’s survey.

Survey: 25% of Participants Aren’t Informed About Deferred Interest

Some of the retail cards listed above feature deferred interest financing offers. These are very different from the 0% APR offers you may have seen on certain cards.

If you take deferred interest offers at face value, they seem like a pretty great deal. You can make a large purchase now and pay it down over time while the balance accrues no interest.

But there’s always a catch. If you miss a payment or can’t pay the balance off by the due date, you’ll be responsible for a larger payment than the one you originally signed up for. That’s because interest will be retroactively applied from the date of the initial purchase to when you missed your payment and for the rest of the term, or to the due date if you weren’t able to pay it off in time.

The interest is deferred, but only if you follow the terms exactly.

Here’s how it might look: You charge a purchase of $4,000 and accept a deferred interest financing option. The terms say you have 12 months to pay the balance to zero while making minimum payments each month, otherwise the 25% interest rate will be applied. While the minimum required monthly payment is, say, $25, you decide to pay $250 each month instead.

However, that still wouldn’t be enough. When your bill comes due, you’ll still have $1,000 to go. And because you failed to pay the balance off in time, you’re now responsible for all of the interest you were hoping to avoid. The accrued interest would be $656.

That means you’re now responsible for the remainder of your purchase plus that interest, a total of $1,656. That’ll appear on your next credit card statement, and it will accrue interest until you pay it off.

Even if your remaining balance is as low as $5, you’ll be held responsible for all of the interest that accumulated in the background. That could be a substantial sum, depending on the purchase price and terms of your offer.

So it’s important to pay off the full balance in time, and to check all of the terms of your deal before agreeing to it. Otherwise, it could be detrimental to your bank account (and maybe your credit scores).

Data Shows Participants Still Regret Their Retail Store Cards

Consistent with last year’s findings, just over 40% of participants indicated they regret getting a retail store card.

The reasons vary, from lack of use to not knowing all of the card details to being bogged down by interest payments. “Because I only used it once, and it’s a pain to cancel, it might affect my credit score,” wrote one person. “I regret not reading the fine print,” commented another.

It’s important to make informed decisions when choosing a card, of any type. Make sure your spending habits fit the card before you apply, and try not to be ensnared by one-time offers. If you’re being docked with interest charges, that initial 30% you saved when you signed up might not be so lucrative anymore.

Take the time to consider your potential new card carefully, and you can avoid the hassle of closing a credit card (which can indeed hurt your credit scores).

Wrapping Up

Similar to last year’s survey, over 40% of participants regret applying for a retail store credit card. But this seems like it could be remedied with more information, and by taking the time to make informed financial decisions.

Some of the biggest gripes, like store cards carrying high APRs and worrying they might impact your credit scores, could be smoothed over with a little extra research.

If you’re not carrying a balance, the high interest rates on these cards really shouldn’t matter all that much. And if you’re making all of your payments on time and not maxing out your credit limits, the effect they have on your credit scores shouldn’t be an issue, either.

Deferred interest financing offers may seem like a good idea on the surface, but if you don’t know very much about them, they could come back to bite you. It’s probably best to avoid them, and instead look into other options like 0% APR offers on purchases and balance transfers.

Methodology

SurveyMonkey was commissioned to conduct this online survey of 2,872 adults over the age of 18 in the United States. All fieldwork was completed from October 15 – 16, 2020. This survey employed a non-probability-based sample during collection to provide nationally representative results.

The Short Version

- Store cards typically have higher APRs than standard credit cards

- Carrying a balance on your card can lead to interest charges, which are troublesome if you’re holding that balance on a high-APR retail store card

- Most credit cards come with a grace period for purchases